Editor’s note: This is part of NBC News’ Checkbook Chronicles, a series of profiles highlighting the financial realities of everyday Americans.

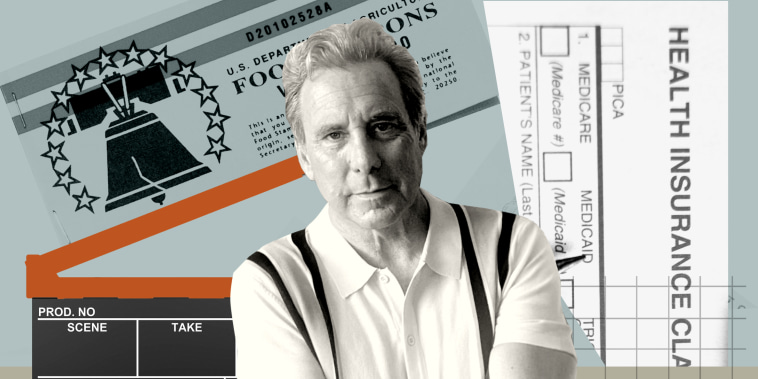

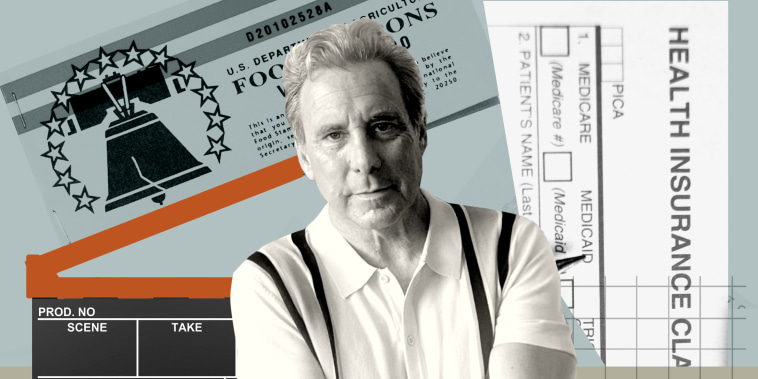

Doug Sharp isn’t a rich man — but he has played one in Hollywood.

Sharp, 59, lives in L.A. and until recently got the bulk of his income by driving for Uber and Lyft, while moonlighting as a paid extra.

It’s the chance to earn the spotlight and others who share his passion for acting that keeps him going after years of failing to find any other kind of full-time work.

Primary source of income: Sharp says he struggles to make ends meet, having survived the past few years off a generous pandemic unemployment reimbursement.

He has begun taking delivery orders on UberEats, but said the pay on that platform barely makes it worth it.

What keeps Sharp going is acting — a notoriously fickle endeavor but one he says has upside potential. He recently obtained a small speaking part in an upcoming production featuring at least two Hollywood A-listers — and saw his daily pay rate go from about $200 to nearly $1,200.

‘The money for background is good, and there’s always the possibility of being upgraded to principal,’ he said. ‘That has happened to me — I have not found a replacement for it.’

Still, it’s not consistent enough for him to obtain full Screen Actors Guild benefits, so his health insurance is through Medicaid.

Living situation: Sharp lives alone, and said his housing situation is unstable. It includes periodically renting from a friend as well as an unauthorized arrangement he wasn’t comfortable discussing on the record.

Economic outlook: After nearly a decade of making steady pay driving for Uber and Lyft, Sharp has effectively quit both platforms for now, in part because, he said, their base pay and regular rates are no longer enough make it worth it to utilize the platforms, especially for what’s needed to live in Los Angeles.

Acting remains enjoyable — Sharp said he is not a celebrity hound and simply enjoys being around other people.

‘The older you get, the less parts there are,’ he said. ‘However the pool of older guys is smaller — and shockingly I always play the rich white guy, because that’s what I look like. But I didn’t I know look like rich white guy until started playing one.’

Yet the gigs have been hardly steady enough to make a career out of.

‘What I can tell you is I barely work,’ Sharp said. ‘In May I worked two days, in April I worked four days, in March I worked two days, in February, I worked two days, in January, I worked one day.’

Budget pain points: Sharp struggles with buying basic necessities, to the point that he found himself recently trying to return goods around his residence back to Home Depot and Walmart for cash or credit.

He owns a car, a Fiat 500, but is trying to obtain a new one through a rental company so that he can get back to driving for Uber and Lyft — even at the reduced rates. However, he’s not sure his credit score will be good enough for him to obtain the new vehicle.

Outlook: Sharp said he basically started his life over in his 40s, when he obtained a business degree from the University of Massachusetts-Amherst. But he graduated in 2013, when the economy was still emerging from the global financial crisis, and couldn’t land a job.

Uber, and later Lyft, provided a lifeline, and he enjoyed the work. But over the years, their rates got lower and lower.

Still, returning to those platforms remains his key financial objective.

In the meantime, Sharp struggles with depression and anxiety.

‘The one thing people hate are educated white men, who look rich but who are poor,’ Sharp said. ‘They think ‘Oh, he must be lazy, or on drugs what is his problem? I get this — I’ve watched my friend group move away.’

‘I am ashamed about where I am in my life as it relates to my finances and not knowing how to fix it,” he continued.

Finding a full-time job — even at a fast-food restaurant, and even in a labor market that the Federal Reserve says remains relatively healthy — has been a lot more difficult than one might imagine.

‘I do qualify for food stamps, I do qualify for [Medicaid],’ he said. ‘I’m not embarrassed about that, but when I’m willing to work — and bust my ass, why is it that I can’t get a living wage?’

Ironically, fast-food jobs are now quite difficult to obtain, Sharp said, not least because their hourly wages are now higher than in many other industries thanks to California’s new $20 minimum wage for workers in the sector.

‘It’s embarrassing because it seems like there’s a piece of the puzzle that I’m not telling,’ Sharp said. ‘I’m doing everything I can.’

This post appeared first on NBC NEWS